SEO is crucial, people keep telling me – ultimately you have to rank your website so that it’s visible (and maybe stop getting only scam emails on my “Contact Me” button) and to do so – there’s no better way than that of utilizing SEO and creating blog posts. You know, like this one.

For example Your Marketing People mentions no less than 7 reasons blog posts are so important for your website:

- They help rank for relevant keywords – the holy grail of all SEO functions

- Increase brand visibility

- Develop brand awareness (as if there’s a difference between “visibility” and “awareness”, AT)

- Boost your crawl rate

- Build backlinks (You can thank me later, Mr. “Your Marketing People”)

- Encourage site discovery

- Generate leads and conversions.

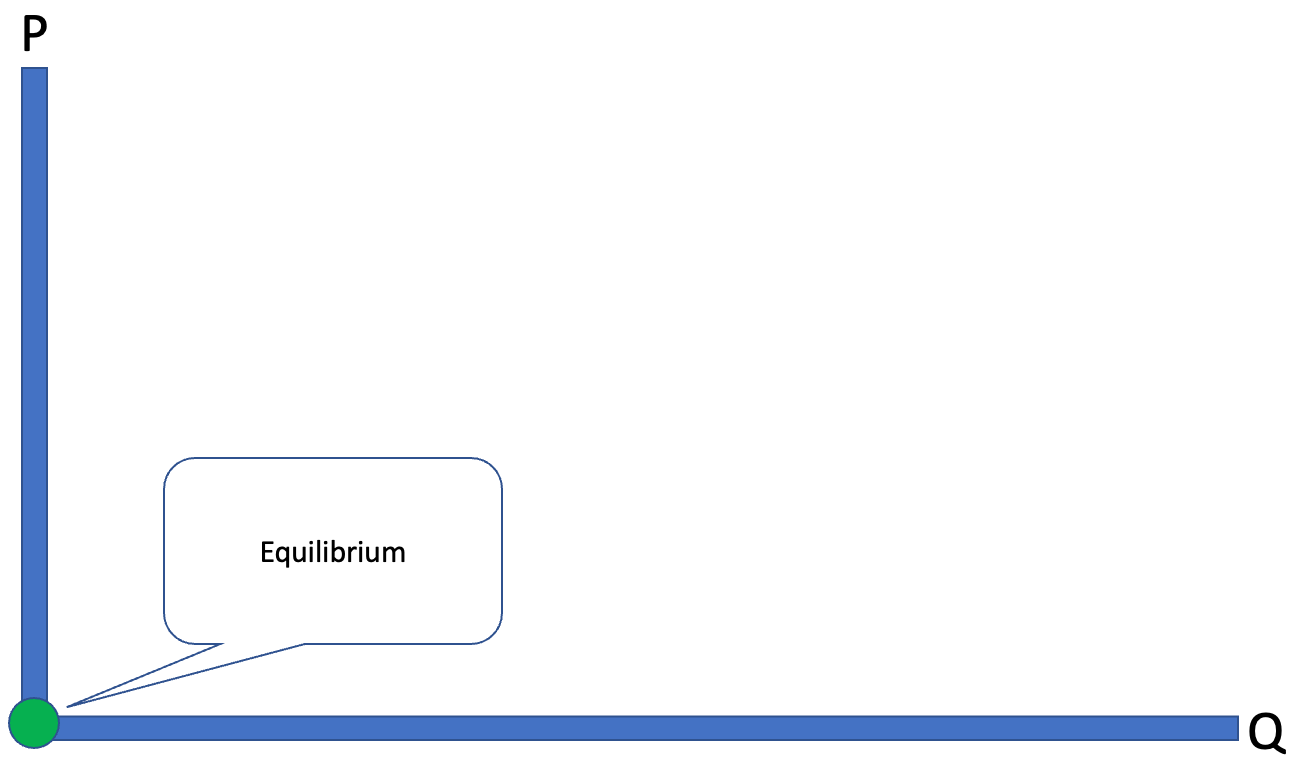

I am sure all these are true, as hundreds of other articles would tell you the same, but not a single article talks about the impact marketing (and specifically SEO) has on market equilibrium. I am serious, although surprised by the results myself – just tap intoGoogle Scholar like a diligent student of the subject and search for yourself. I dare you to find anything.

However, in learning from these, it is clear that there is a real need to hide keywords of my business within this blog post – so let me PITCH you an idea, I will be MODELING the impact of MARKET RESEARCH on PRICING of products, and maybe even give someone an idea for a BUSINESS PLAN, or at least an OPERATIONAL PLAN.

And while I will try to mention some of the above key words in the rest of the post, the main point is this – can I write something meaningful, without any academic literature (as already discussed and agreed upon, in fact, here are the search results.

Except, then I remembered I am a after all a MARKET RESEARCHER so I am probably missing something and indeed, in 2015 Davcik and Sharma completed a comprehensive study about the impact of marketing investments and brand equity on pricing, and lo and behold this is their conclusion: “The study suggests that brand equity, marketing investment and product differentiation are closely associated with price. Using a cluster analysis, the authors found that the premium price is significantly associated with product differentiation based on innovation and company type.”

Indeed this is a study on the impact of marketing and not necessarily SEO, and its a study on its impact on pricing and not necessarily market equilibrium – but I’ll take what I can find.

And while as a boot-strapped consultant, the pricing of $37 doesn’t justify buying the publication for which I can read the abstract and results – the conclusion is clear, mostly because the acclaimed researchers share it and their caveats freely: “The role of the value in brand performance output has not been investigated in the financial context, only in consumer or marketing mix context. Little is known about how price strategy depends on brand equity, product innovation activities or marketing investments intended to improve brand performance, neither how this strategy improves brand performance among different players in the market (retailers, SMEs and MNCs).”

Investopedia would tell you the same, in a much less “academic” research paper with much less evidence but with one distinct advantage – it is free, Adam Hayes mentions the likes of Tylenol and Starbucks as great examples of how brand equity impacts profit margins. And while Adam might have been confused in regards to the actual terminology (profit margin vs. PRICING) – it is true indeed that Coca Cola is pricier than Pepsi and Tylenol pricier than whatever the CVS brand might be. I am not sure these examples relate to the difference in PRICING between two lawyers, two marketing agencies or two cast iron pans but be that as it may – it is undoubtedly true.

This concept should also not be confused with the impact of product differentiation on pricing, the authors here too, mention Coca Cola vs. Pepsi as their leading example – but product differentiation doesn’t impact market equilibrium – if there is a difference in the product itself then its supply and demand curve are, by definition, different. That of Coca Cola might look like that of Pepsi and there are clear interactions and substitutions, but it’s still not the same exact curve.

However, the point I am trying to make in this article is different – it is not merely about the impact marketing or brand equity has on PRICING (yes, more marketing means you are more visible and can charge more, that’s kind of the point) – but it actually changes the market equilibrium itself – and more importantly it changes both the demand AND the supply curves.

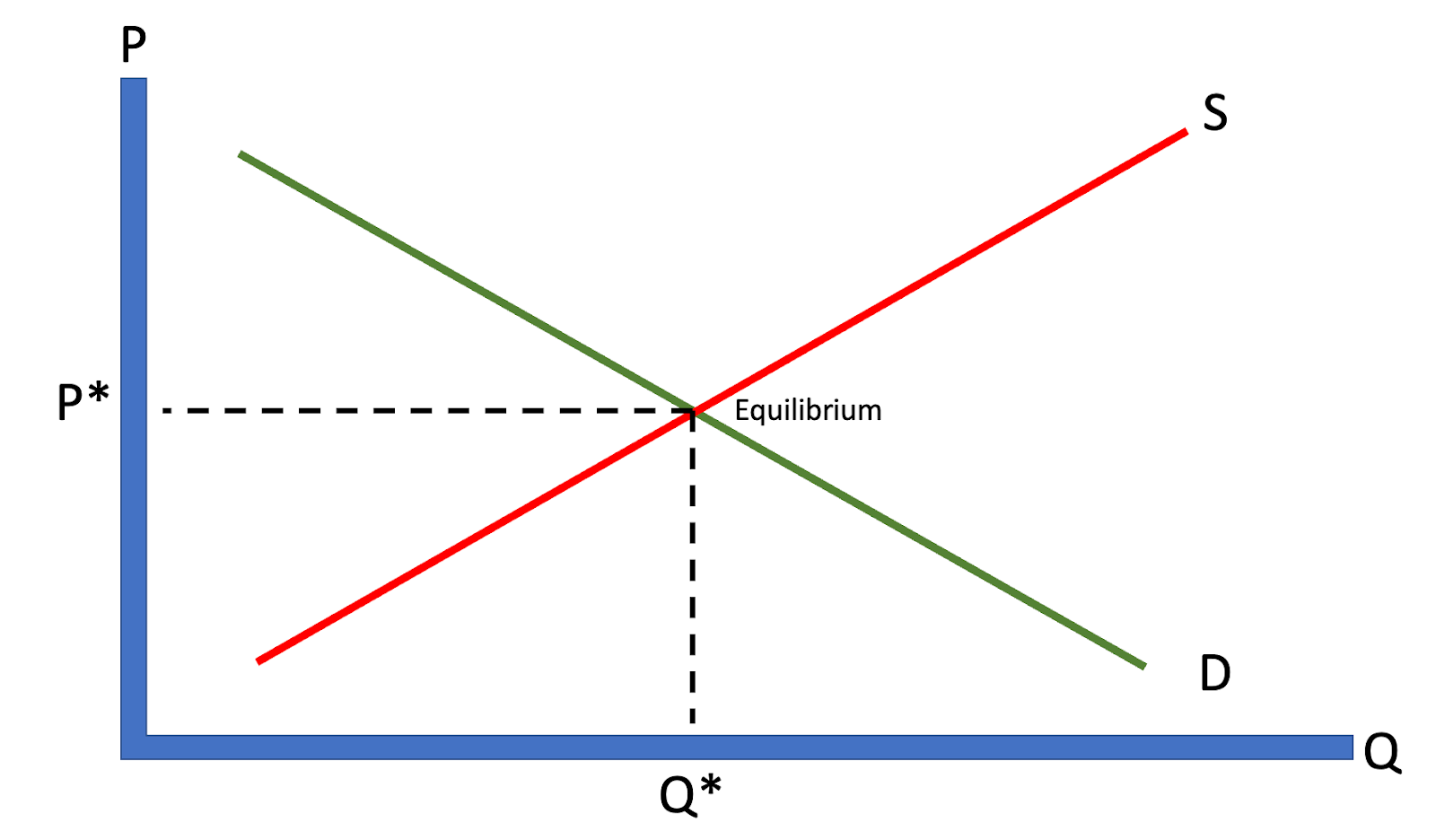

I am sure most of you have seen this before, and if not – there is a supply curve which increases Quantity as Price increases, a demand curve that goes the other way, and a theoretical meeting point where Costco charges you $5 for a grilled chicken.

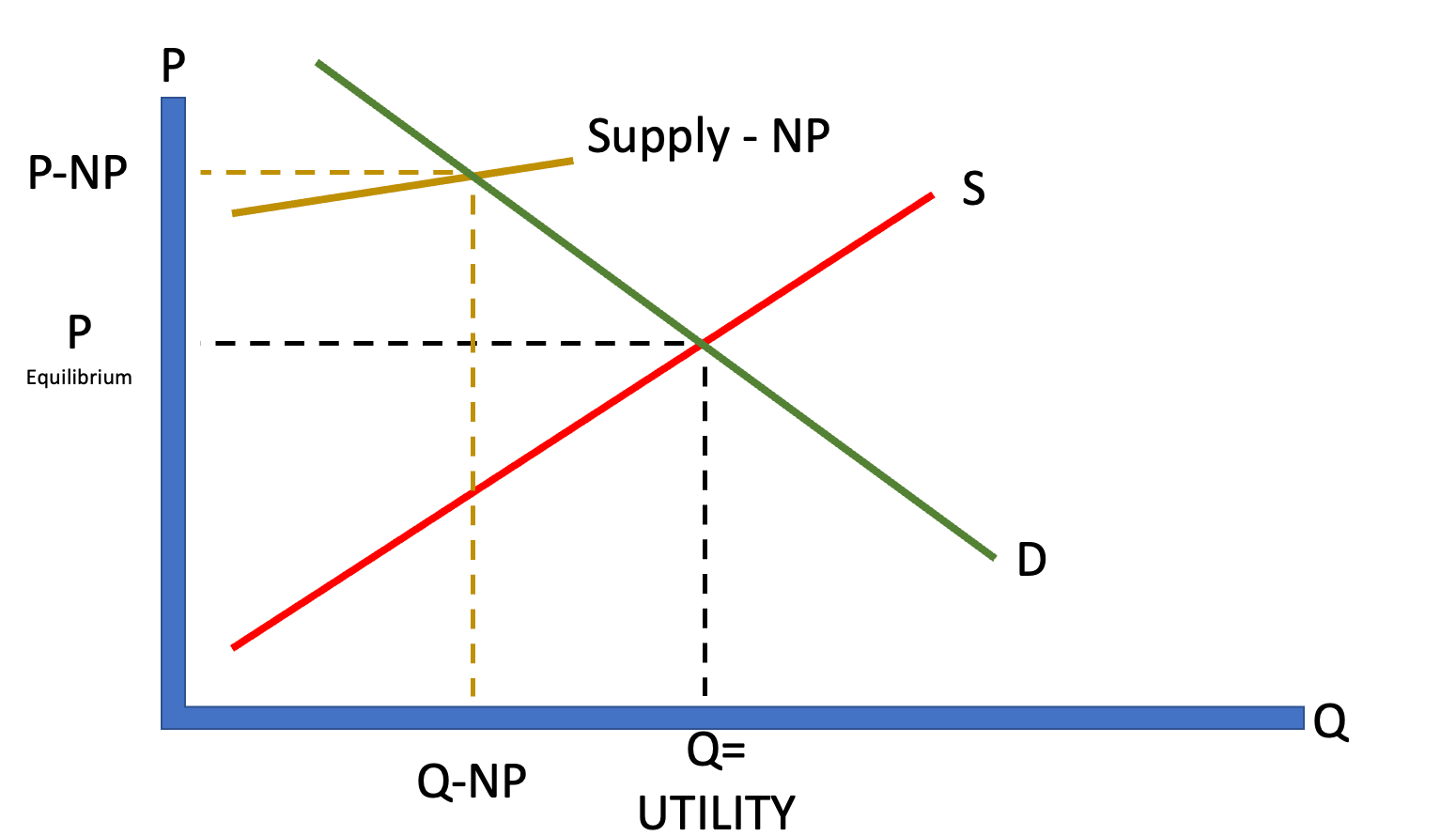

With efficient SEO (or marketing, but let’s stick to SEO as this is a meta-post after all), the cost of supply increases. Yes, SEO, strictly speaking, is not a COG, and yet it does “increase the cost of production” almost by definition, hence the supply curve shifts up to a place where Quantity is lower and Price is higher.

But of course, the impact on supply is ultimately miniscule. The real impact is on demand – good SEO can create two things:

- Awareness and demand for all competitor products (e.g. without Red Bull, there would have been no energy drink market and I would have been constantly tired)

- Specific demand for the specific product

Resulting in Q3 and P3 which would look like this:

Seemingly a win win situation, where the manufacturer or service provider can offer more for more and the customer, while undoubtedly poorer for it, satisfies their new appetite for more of the same in this land of eternal consumption.

Except, this is where “utility” comes in – or more specifically the customer’s utility. One example I love here, since we are discussing SEO, is, well – SEO providers.

Now, in all honesty, I don’t know much about SEO, so it’s hard for me to compare one SEO agency to another, these are not apples to oranges but more like Hala Fruit to Kiwano, however my assumption is, I am not the only novice out there – which means the only real way to compare between the two, other than referrals, is by comparing Reviews.

Let’s take Neil Patel on the one extreme. He famously charges thousands of dollars per hour for his SEO services for a decent average review (Trust Pilot, G2) of around 4.4 – 4.5. Conversely there are 25 different “affordable” SEO services mentioned here, of which Pronto Marketing for example has an average of 4.8, Sube has an average of 4.6 (albeit only 10 reviews..) and Intero Digital 4.9

Does this mean they are better? I don’t know, but one thing is true – Neil Patel does a better job at marketing itself than they do, otherwise they could have also charged thousands per hour and not hundreds per month.

Or in other words – there is no hard evidence that tells me that Neil Patel’s service is better in any way than hundreds or thousands of others, but there is evidence he charges more. Much more.

So, let’s assume the same utility for the customer can be achieved by both the very expensive SEO services (which will be denoted as NP for obvious reasons), and by many (although probably not all) “cheaper” services – here then we can find 2 different supply and demand equilibriums, as follows:

NP in Gold (for obvious reasons), has a much shorter supply curve, where equilibrium is met with high prices, whereas the actual utility is met by the market demand and supply, at a much lower price and much higher quantity.

Of course, you can change Neil Patel and “all others” with McKinsey and “Other Consultants” ; Brioni and “Other Suits”, Bugatti and your neighbor’s 2004 Saturn as well as with hundreds of other similar examples, but remember – this is a meta SEO post, so let’s keep it that way.

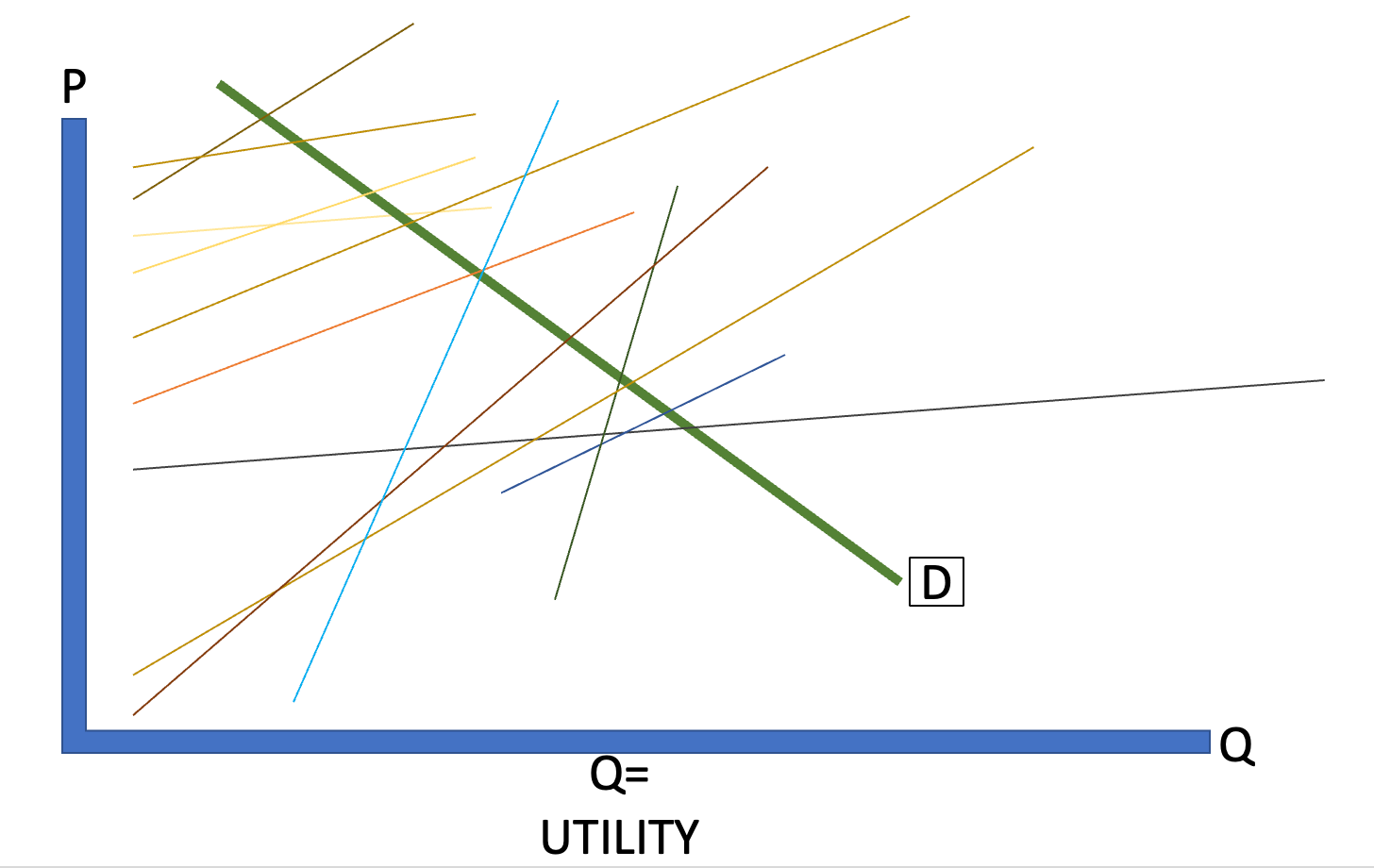

Back to our topic though, there is no NP vs. Market, but indeed, there are hundreds of NPs, some more expensive, some less, and there are thousands of “others”, some more expensive, some less, some do their SEO to their SEO better, some worse, and all create very different supply and demand curves, that might converge, but really don’t. And they don’t because nobody, including Google or even modern and popular AI models are doing their jobs of providing full transparency into the market.

And what we are left with are a million supply curves of all shapes and forms, lengths and slopes, basing their pricing on how good they do their own marketing / SEO, but really only one actual demand / utility curve:

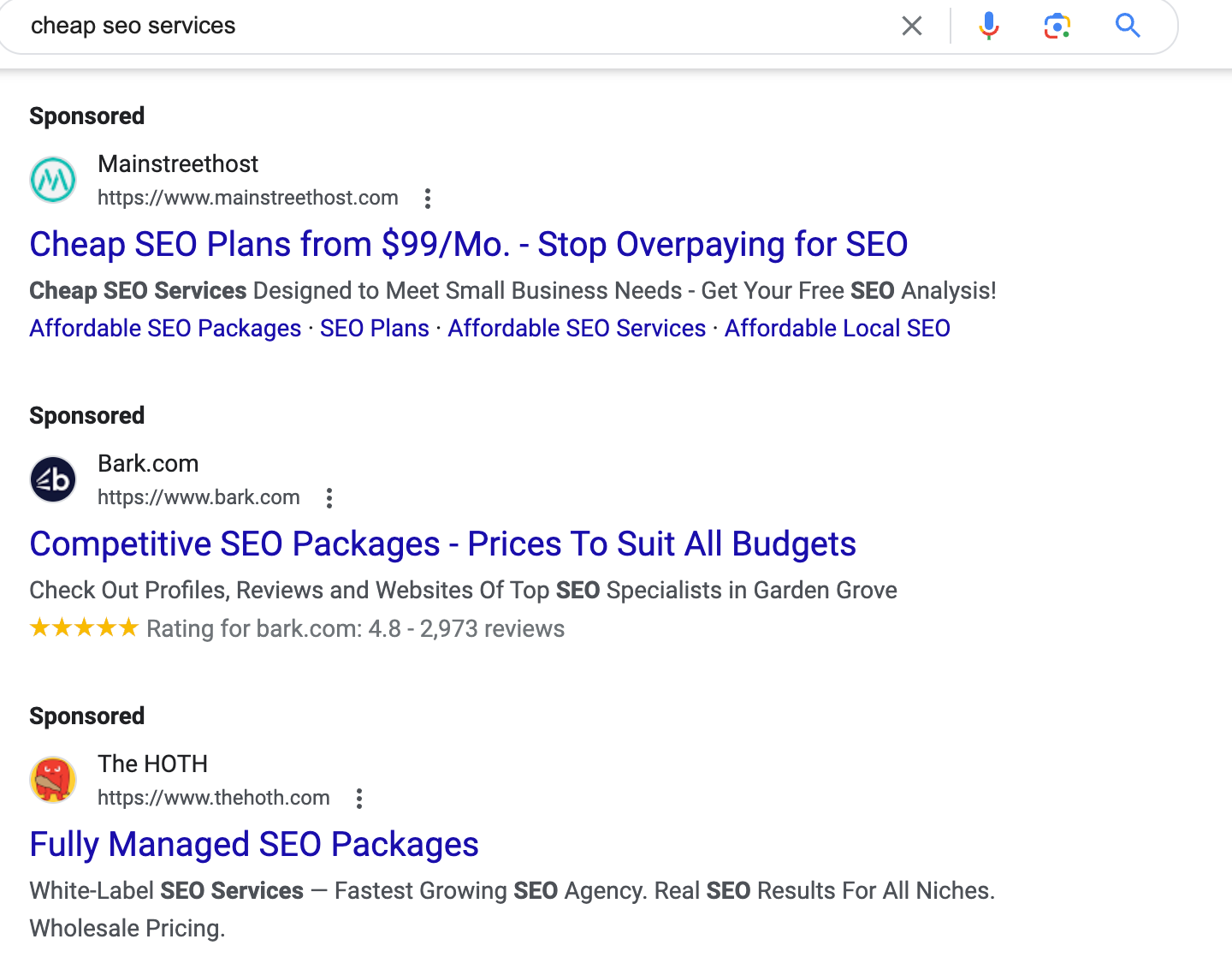

And if you really need one more piece of evidence to tell you how broken the market is (again, not just this one, but it’s meta etc…) then just remember – many SEO companies are using SEM (= paid search) to advance their offerings – and if they don’t believe in their own SEO, who are we the customers to defy them:

The mind boggling conclusion is different though – you see, in an ideal world with a truly objective search engine (AI – I am looking at you to one day, change this), the curve actually looks like this:

Because in a world where data is truly transparent, where the value of a service is derived strictly by real reviews and where there is transparent pricing and utility, there is no SEO – SEO is ultimately a made up industry which can only survive due to lack of data. SEM is different – Google is entitled to earn money for all the value it brought to the world in the last 30 years, but SEO, unfortunately, like so many other businesses (primarily in America) is truly and purely, a made-up business

And yet – I play the game too, everybody has to. Unfortunately. You buy Bitcoin because others believe in it, you use SEO because everybody else does.

But remember this – to get to that 0,0 equilibrium in SEO or any other business, real MARKET RESEARCH is needed, which is where I come in. So… Contact me.